Has Your Family Office Had a Personal Security Assessment?

Andre Johnson

Family offices are increasingly turning to FocusPoint International (FocusPoint) to reduce their exposure and off-set the costs of a personal protection program and thanks to a little-known Internal Revenue Services’ code, this security assessment is basically available at no cost. If your family office hasn’t had a Personal Security Assessment yet, it should do so immediately in light of IRS tax regulations.

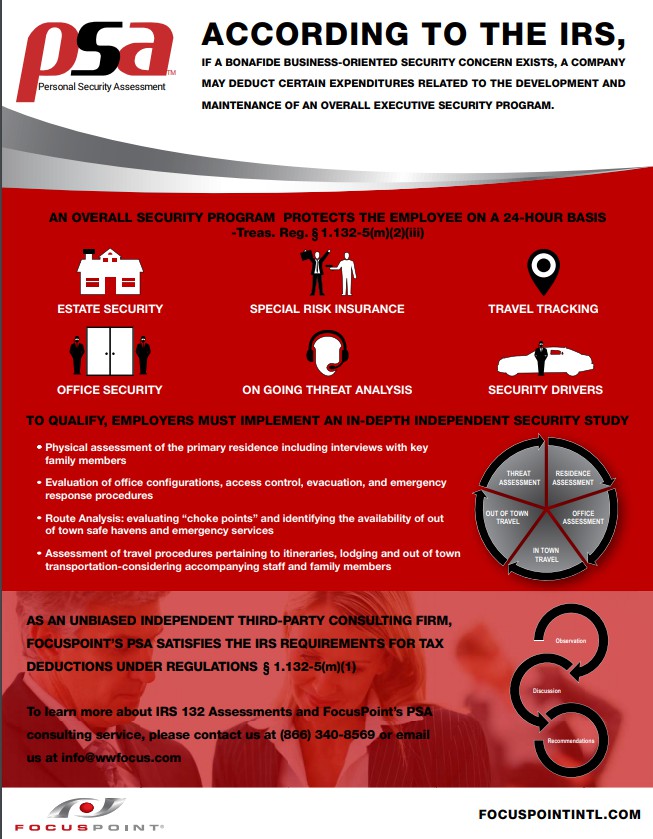

“According to the IRS, if a bonafide business-oriented security concern exists, a company may exclude certain expenditures related to an employee,” reports FocusPoint CEO Greg Pearson. “As a result, family offices can take advantage of this to defray the costs associated with estate security, air and ground transportation, special risk insurance, threat analysis and office security.”

A few key points to consider include:

-Corporate executives and high net-worth individuals within a recognized corporate structure often receive extraordinary fringe benefits not provided to other employees of that same recognized corporate structure that may be subject to tax. The Internal Revenue Code (“IRC”) was amended in 1984 to include the term “fringe benefits” in the definition of gross income which must be treated as compensation includible in income under § 61 unless there is a specific statutory exclusion that applies to the benefit.

-Under § 1.132 5, certain statutory exclusions exist if a “bona fide business-oriented security concern” exists. A “bona fide business-oriented security concern” exists only if the facts and circumstances establish a specific basis for concern regarding the safety of an employee. Treas. Reg. § 1.132 5(m)(2)(i).

-Under Treasury Regulation § 1.132- 1(b)(2), “employee” means: 1) any individual who is currently employed by the employer; 2) any partner who performs services for the partnership; 3) any director of the employer; and 4) any independent contractor who performs services for the employer.

-No bona fide business-oriented security concern will exist unless the employer establishes to the satisfaction of the Commissioner of Internal Revenue that an “overall security program” has been provided with respect to the employee involved. Treas. Reg. § 1.132-5(m)(2)(ii). An “overall security program” is one in which security is provided to protect the employee on a 24-hour basis. Treas. Reg. § 1.132-5(m)(2)(iii).

-An overall security program will be deemed to exist in situations where the employer conducts and implements an “independent security study” with respect to the employee. Treas. Reg. § 1.132- 5(m)(2)(iv).

FocusPoint International is routinely engaged by corporations and family offices to conduct personal security assessments (PSAs) to meet the requirements of IRS 132. The first step is to establish a “baseline of threat” and a practical, threat-based overall security program. The PSA identifies current threat conditions and lifestyle dynamics to determine the resources required to establish and implement an effective and reasonable security program. As an unbiased, independent third-party consulting firm, FocusPoint satisfies the IRS requirements for tax credit under IRS regulations.

To learn more about IRS 132 Assessments and FocusPoint’s PSA consulting service, please call 866.340.8569 or email [email protected]

Source: https://familyofficenetworks.com/has-your-family-office-had-a-personal-security-assessment/